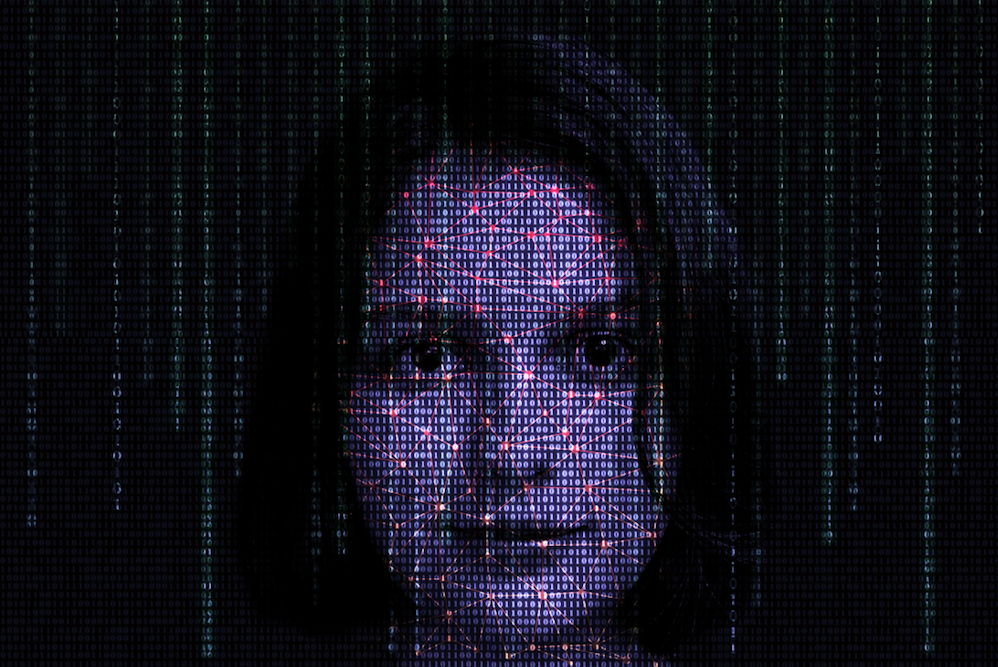

Although there is much excitement surrounding the advent and development of artificial intelligence (AI), there are some serious risks involved – namely, the prevalence of scams that are becoming increasingly sophisticated.

Types of scams

There are a few main scams to be aware of:

- Deepfakes are essentially fake media content that is very believable. For example, a video clip of financial expert and broadcaster Martin Lewis was recently fabricated, aiming to convince viewers to part with their money. This AI software can also clone voices and use them to make fraudulent phone calls. In a recent survey (7), 77% of those respondents who had been victims said they had lost money because of this kind of scam.

- Images and videos can be created of people to pass through security and verification checks, thus gaining access to bank accounts

- ChatGPT enables phishing scams to seem more convincing by making the tone more human and filtering out any spelling or grammatical errors.

Who is at threat?

Everyone risks falling victim to these scams, regardless of age. In fact, research (8) has found that 48% of adults between the ages of 25 and 34 have experienced financial fraud, while only 28% of over 55s said the same.

What can we do?

Andrew Bailey, Governor of the Bank of England, commented, “The time to act to safeguard our society from AI-enabled fraud is now, and all organisations need to think carefully about how AI may create fraud risks for their business and their customers. This will require ongoing vigilance, including monitoring and the sharing of insight and best practice between firms and across sectors.”

We understand that the threat of scams can feel overwhelming, especially when the capability of AI is constantly changing and developing. That’s why it’s important to question everything, equip yourself with knowledge so you’re not vulnerable and, if in doubt, get in touch for guidance.

(7) McAfee, 2024, (8) GFT UK