The New ISA

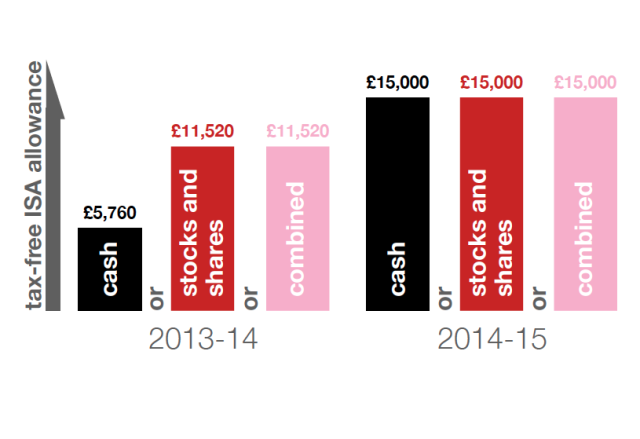

From 1 July 1 2014 all ISAs will become New ISAs (NISAs). This applies to all existing ISAs and new accounts opened after 1 July. The Government is changing the name to reflect the significantly increased limits and flexibility that will be available to account holders. The NISA will be more generous and will offer flexibility to save your NISA annual allowance of £15,000 in cash, stocks and shares or any combination of the two. Under the NISA rules you will also be able to transfer previous years’ ISA savings freely between stocks and shares and cash if you wish

What is changing on 1 July 2014?

From 1 July 2014, you will be able to split the amount you pay into an ISA between a Cash NISA and a Stocks and Shares NISA as you choose – up to the new overall annual NISA limit of £15,000. Previously, it has only been possible to save up to half of the overall ISA subscription limit in a Cash ISA. Any subscriptions you have made to an ISA since 6 April 2014 will count against the £15,000 NISA subscription limit for 2014-15. If you have paid into a Cash or Stocks and Shares ISA since 6 April 2014, you will not be able to open a further NISA of the same type before 6 April 2015. You may however make additional payments – up to the £15,000 NISA subscription limit – into your existing account(s) or by transferring those account(s) to another provider that will allow additional amounts to be added.

What is the limit for NISA savers under the age of 18?

If you are aged between 16 and 18, you can hold a Cash NISA but cannot open a Stocks and Shares NISA. From 1 July 2014, you will be able to pay up to £15,000 into your Cash NISA for the tax year 2014-15. This is in addition to any amounts that you pay into a Junior ISA that you hold.

Can I now have a single NISA for both my cash and stocks and shares investments?

Yes, you will be able to hold cash tax-free within your Stocks and Shares NISA if you wish and your provider allows this. However, many savers may prefer to hold separate accounts for cash and stocks and shares investments, and can continue to do so.

What are the rules for making deposits to an ISA between 6 April and 1 July 2014?

Between 6 April and 30 June 2014, the total amount you can pay into a Cash ISA is £5,940. If you have a Stocks and Shares ISA, you can also pay into that account, but the combined amount you pay into your Cash and Stocks and Shares ISAs must not exceed £11,880.

From 1 July 2014 however, you can (if permitted by your account terms and conditions) make additional payments to your Cash or Stocks and Shares NISAs in whatever combination you choose, provided that you do not pay in more than the overall NISA limit of £15,000 within the tax year (6 April 2014 to 5 April 2015). Any amounts that you have paid into an ISA between 6 April and 30 June 2014 will count against your £15,000 NISA subscription limit for 2014-15.

Examples

- On 10 April 2014, you pay the maximum amount allowed into a Cash ISA (£5,940). You do not want to pay into a Stocks and Shares ISA in this tax year. From 1 July the limit will increase and your account will become a Cash NISA. Subject to your account terms and conditions, you can add any amount to your account, up to the new limit of £15,000. Therefore, between 1 July 2014 and 5 April 2015, you can pay in a further £9,060 (£15,000 minus £5,940).

- On 20 April 2014, you pay £100 into a Cash ISA and £500 into a Stocks and Shares ISA. From 1 July the limit will increase and your accounts will become NISAs. Subject to your account terms and conditions, you can add further amounts to either account, provided that your total payments for the tax year do not exceed the new limit of £15,000. Therefore, between 1 July 2014 and 5 April 2015 you can pay in a further £14,400 to your two NISAs (£15,000 minus £600) in any combination that you choose.

- On 1 May 2014, you pay the maximum amount allowed into a Stocks and Shares ISA (£11,880). From 1 July the limit will increase and your account will become a Stocks and Shares NISA. Subject to your account terms and conditions, you can add any amount to your account up to the new limit of £15,000, or open a Cash NISA and pay into that account. Therefore, between 1 July 2014 and 5 April 2015, you can pay in a further £3,120 (£15,000 minus £11,880).

Why can’t I invest my overall ISA limit in cash from 6 April 2014?

The new rules apply from 1 July 2014. This is to give ISA providers sufficient time to prepare to apply the new limits from that date.

Why does the ISA subscription year run from 6 April to 5 April, and not on calendar years?

This has always been the case since ISA was introduced, and reflects the fact that as a tax-advantaged account, the ISA year is the same as the tax year. Will this change only apply for 2014-15, or is it permanent? The new rules will apply for amounts paid to a NISA in 2014-15 and in future tax years. Each autumn, the Chancellor usually announces the new ISA limits for the next tax year.

I have paid into a Cash ISA before 1 July 2014 and this doesn’t allow me to add further payments. What can I do?

You should discuss this with your ISA provider. You can only pay into one Cash ISA and one Stocks and Shares ISA in each tax year. So, if you have paid into a Cash ISA since 6 April 2014 and the terms and conditions of this account do not allow further amounts to be added, you cannot open another Cash ISA before 6 April 2015. However, you may make additional payments by opening a Stocks and Shares account, or by transferring your Cash ISA to another provider that will allow additional amounts to be added. The terms and conditions of your account should make clear whether there are any restrictions on the number of payments that you can make.

I hold a Junior ISA – is the subscription limit changing?

Yes. On 1 July the amount that can be paid into a Junior ISA for 2014-15 will increase to £4,000.

What is changing on 1 July 2014?

From 1 July 2014, you will be able to transfer amounts you hold in a Stocks and Shares NISA to a Cash NISA. This applies to amounts that you have paid in since 6 April 2014 as well as amounts that you have paid in during previous tax years. As currently, you will also be able to transfer any funds from a Cash NISA to a Stocks and Shares NISA if you wish.

How do I transfer savings from my Stocks and Shares NISA to Cash NISA?

From 1 July 2014, you should approach the provider of the Cash NISA you wish to transfer your funds to, who will contact the manager of your Stocks and Shares account to arrange the transfer. You should not withdraw sums from your Stocks and Shares account yourself in order to deposit it into a Cash NISA. If you do, any amount that you pay in may count as a fresh payment against your overall limit of £15,000.

What amounts can be transferred from a Stocks and Shares NISA to Cash NISA?

Different rules will apply depending upon when you paid the relevant amounts into your Stocks and Shares ISA.

- If you wish to transfer savings relating to any current year’s payments to your account: (i.e. amounts you have paid in after 6 April 2014), you must transfer these as a whole.

- However, any savings relating to payments to your account in earlier years (amounts you have paid in before 5 April 2014) can be transferred to a Cash NISA in whole or in part. Not all ISA providers will allow part transfers, so you should check this with the provider of your Stocks and Shares NISA when deciding whether to transfer. Can I transfer savings back again? Yes – after 1 July 2014 you can transfer between Cash and Stocks and Shares NISAs as many times as you wish.

How long will the transfer take?

If you transfer savings from a Cash NISA to another Cash NISA your transfer must usually be completed within 15 business days of you requesting it. Any other type of account transfer must usually be completed within 30 days of you requesting it.

Can I now have a single NISA for both my cash and stocks and shares investments?

Yes, you will be able to hold cash tax-free within your Stocks and Shares NISA if you wish, and your provider allows this. However, many savers may prefer to hold separate NISAs for cash and stocks and shares investments, and can continue to do so. 4. New rules on NISA investments from 1 July 2014

What is changing on 1 July 2014?

From 1 July you will be able to acquire the following investments to hold in your Stocks and Shares NISA:

- Certain Core Capital Deferred Shares issued by a building society;

- Certain securities, such as retail bonds, which have less than 5 years to run to maturity at the time they are first held in your account; and Certain investments that do not currently satisfy the current ‘cash-like test’ for Stocks and Shares ISA – such as some company shares, units or shares in a collective scheme, and some types of insurance policy.

In addition, cash held in Stocks and Shares NISAs need not be held for the purpose of investing in qualifying investments. Any interest arising on this cash will not be subject to a flat rate charge of 20 per cent. If you wish to hold any of the above investments in your Stocks and Shares NISA, you should discuss this with your provider, who will be able to advise further.

Can I hold a peer-to-peer loan or securities offered via crowdfunding platforms in my NISA?

The Government intends to enable peer-to-peer loans to be held within NISA and will consult on how to implement this later this year. The Government will also explore extending NISA eligibility to debt securities offered via crowdfunding platforms.

Source: http://www.hmrc.gov.uk